- Contact Us

- Find Us

- BSB: 645 646

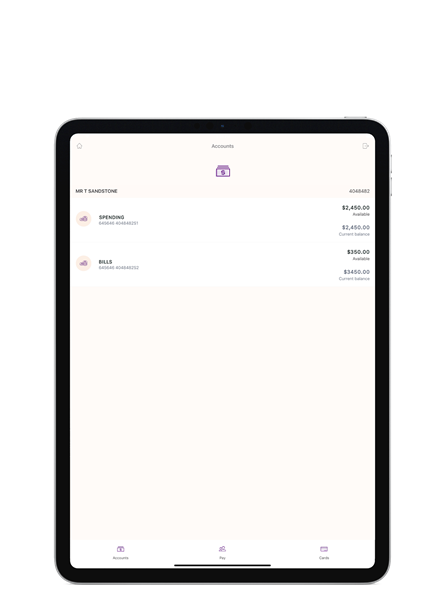

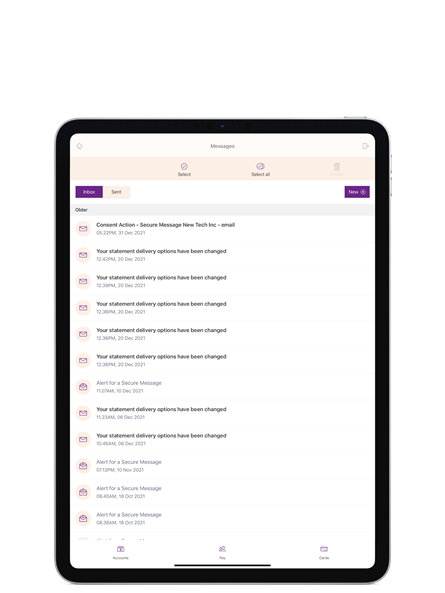

Internet Banking lets you check balances, manage your accounts, personal details and limits, plus send and receive money securely.

Register for internet banking by clicking the ‘Register Now’ button below and completing the online form, visiting a branch or calling our Customer Care Team on 1300 138 831 between 8AM and 6PM AEST weekdays (excluding Public Holidays).

Need some help?

|

We’re here to help.

#Can only be performed if registered for SMS Secure

~Subject to a daily transfer limit set by you.

^Except for payments directed to loan accounts.

+ some instructions may need to be received in writing with signatures

* Auswide Bank Ltd (Auswide Bank) ABN 40 087 652 060 AFSL 239686 has appointed Convera ("Convera") ACN 150 129 749; AFSL 404092 to assist it in fulfilling certain foreign exchange and payment services, including telegraphic transfers. These services are provided to you by Auswide Bank. Fees and charges may apply, please refer to the terms and conditions issued by Auswide Bank and our Auswide Bank Financial Services Guide.

Apple, App Store, iPhone, iPad, iPod, Touch ID and Face ID are trademarks of Apple Inc., registered in the U.S. and other countries. Google Play and the Google Play logo are trademarks of Google LLC. Temporary service disruptions may occur.

® Registered to BPAY Pty Ltd (ABN 69 079 137 518)